How much does it cost your business to acquire a new customer?

If you don’t know the answer, then you’re missing out on an important piece of data that can help you improve return on investment (ROI) for your marketing and run a leaner, healthier operation by better understanding the cost of acquiring customers.

Fortunately, it’s not difficult to find this figure—known as CAC or customer acquisition cost. This article will show you an easy customer acquisition cost formula, and explain how to improve your CAC for a better bottom line.

CAC Meaning: What does CAC stand for?

Customer Acquisition Cost, or CAC, is a figure that shows how much you must invest in marketing on average to convert a single customer. CAC is sometimes referred to also as Cost Per Acquisition (CPA) by some writers and businesses. CAC and CPA refer to the same thing - the acquisition cost (in marketing dollars) of a new customer.

Calculating CAC requires not just the budget you invest on advertising campaigns, but also the other sales and marketing expenses associated with marketing to customers.

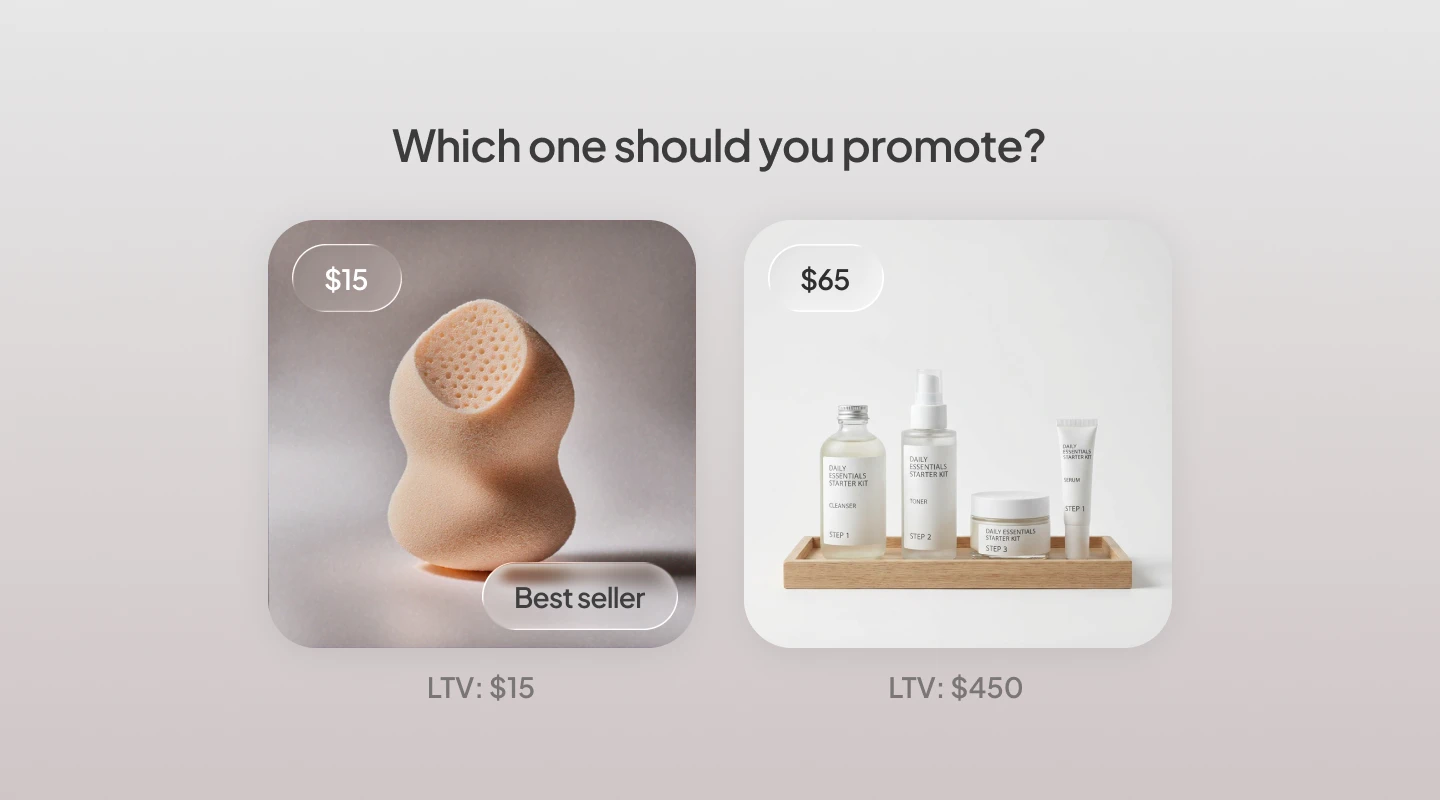

CAC is an important figure to help you calculate customer lifetime value (CLV), and it’s closely related to return on ad spend (ROAS).

Customer acquisition cost formula

Customer Acquisition (CAC) = Cost of Marketing / Number of New Customers

This formula is essential for businesses to accurately calculate customer acquisition cost and optimize their marketing strategies.

What you need to calculate CAC

To start out, you need to define a time period—it can be a few weeks or months, or more than a year. You may want to calculate CAC over the same time span as specific marketing campaigns, to see what the ROI was for those specific campaigns and better understand your customer acquisition costs.

Number of new customers

The first figure you’ll need to calculate CAC is the number of new customers acquired over the time period you’re examining. Remember, CAC is about acquiring customers, so this figure should only include new customers, not pre-existing customers, to accurately reflect your acquisition costs.

Marketing budget

Next, you’ll need the amount you spent on your marketing campaigns, including all marketing expenses such as paid advertising campaigns like Google Ads, Facebook or Instagram (Meta) Ads, or even TikTok Ads.

Also bear in mind that you should only be factoring in marketing budgets as they relate to customer acquisitions. You wouldn’t include marketing costs for retaining existing customers.

Salaries for your marketing team

Your customer acquisition cost formula doesn’t just account for the money you invest on advertising platforms, but all the costs of running your marketing department, including sales expenses. This includes the salaries you pay to anyone on your marketing team.

Miscellaneous marketing spend

Think carefully about where else you might be spending money on marketing. For example, if you invest in software to analyze your marketing, or hire contractors to carry out the work, then these costs need to be included in the formula as well.

When you’ve obtained the number of new customers acquired, and all of the sales and marketing costs that go into recruiting fresh leads, then you can plug them into the formula above and voila—you have your CAC.

Customer acquisition cost example

Here are some customer acquisition cost examples to illustrate how CAC is calculated in a real-world scenario.

Imagine you are a business that offers online software product, where a lifetime subscription costs $350.

You want to know your CAC over the last year, when you ramped up your marketing efforts. So you start to gather your numbers:

- In the course of a year, you obtained 3,000 new customers.

- You invested $25,000 in marketing

- You paid your marketing employees a total of $150,000

- You also spent $1,000 on marketing tools and software

To calculate CAC, you would use the following formula:

($25,000 + $150,000 + $1,000) / 3,000 = $58.67

In this case, the CAC would be just under $60.

Considering that each customer spends $350 when they sign up, you’d be making approximately $291.33 per customer acquisition.

This example shows what a good CAC might look like, but remember that your own CAC will depend greatly on how much you charge for your products and how much you spend on marketing.

CAC marketing tips

If you run your numbers through the CAC formula and find it’s costing too much for you to acquire new customers, there are some customer acquisition strategies that can help you improve your CAC.

Re-analyze your marketing

The first thing you should do if you’re troubled by a low CAC number is to reanalyze your sales and marketing efforts overall. A low CAC indicates that you are overspending on marketing—or that your existing sales funnel is unsuccessful.

Take a look at your return on ad spend, or ROAS. This will help you pinpoint which marketing campaigns may not be giving you the return on investment you need.

You can use a variety of metrics to determine where the issue lies. Click through rates on social media and email marketing is a good place to start. You can also examine the customer journey to find out more—for example, if you’re investing in SEO, how much of the organic traffic you’re gaining from SEO is resulting in a conversion?

When you’re done running the analysis, reallocate your marketing spend by eliminating campaigns that aren’t bringing in the results you want, and investing in those that are pulling their weight. You may also want to experiment with different marketing channels, to see if those resonate better with your audience.

Launch a customer referral program

One of the best ways to increase your CAC is by tapping your marketing and sales teams to help you bring in new leads. This is particularly useful for businesses that have a loyal, happy customer base with a long customer lifetime value.

To launch this campaign, you simply need to offer a referral program to your existing customers—for example, you can give them a free product, or a discounted subscription if they refer a new customer. Promote this program through your marketing channels, and you should be able to balance out your CAC.

Target customer abandonment

The reason for your low CAC may lie in the onboarding process you have for new customers, which includes all marketing and sales expenses. If people are falling off at some point during the beginning of their journey, then you can improve CAC by finding ways to stem the loss.

This is why so many online retailers make use of cart abandonment & browse abandonment emails—messaging that reminds customers to come back if they’ve started to make a purchase but not followed through. Something as simple as optimizing when you send an email or SMS can make a huge improvement in conversion rates.

You can find your Cart Abandonment Rate inside Shopify’s dashboards or from most other commerce platforms.

Use data to better understand your customers

One of the best ways to improve your CAC is to investigate your existing customers and their habits, which can help you better manage your acquisition costs. You can use this information to fine-tune your marketing strategy and improve your conversion funnel.

Segments by Tresl is designed to help Shopify users gain a deeper understanding of their customer base, and tailor their marketing to improve CAC, acquisition costs, and a host of other marketing metrics.