- This blog post is written by Alex Greifeld from No Best Practices

This newsletter draws from my real learnings working with consulting clients, or from my former life working as an FTE for brands like Coach and Tibi.

But I can only work with 2-3 clients at a time. In the interest of bringing you a broader set of learnings, covering topics I don’t always get to work on, and just keeping things interesting…

…I’ve decided to release a “partner” newsletter once per quarter. I’ll share a case study from a real brand, outline their winning tactics, and add some of my own POV. I’ll always tell you which newsletter is the “partner” edition, and I vet all the case studies for validity.

My first partners: ILIA Beauty and Segments Analytics.

ILIA Beauty is one of the OG clean cosmetics brands, famous for their SPF skin tint and mascara. Segments Analytics integrates with your Shopify store and finds you actionable, profitable customer segments instantly, then lets you push those segments to your marketing channels seamlessly.

Read on to find out how ILIA worked with Segments Analytics to lift their repeat purchase rate and customer LTV, how retention can actually help you scale acquisition, and how you can do the same.

Why Is It So Hard For eCom Brands To Retain Customers?

Mono-brand eCommerce is a high churn business by its nature. There are some exceptions–subscription products with high switching costs, like baby formula and dog food. But most brands will be lucky if 25 of every 100 new customers make a second purchase. Ever.

That’s right: on average, only 1 in 4 of your new customers will ever make a repeat purchase.

Some brands have a higher repeat purchase rate–I’ve seen rates up to 38%, but it will almost never exceed 40%.

And some brands have a lower repeat rate–but if it’s 20% or lower, you probably have merchandising issues or your marketing is overpromising and under delivering.

Why does this happen? There are two main reasons:

- DTC brands are easy to forget.

- To win a repeat purchase, you need something else that your customers want to buy.

Reason #1 is especially acute for those brands who drive almost 100% of their customer acquisition on Meta. The package arrives and the customer uses the product, receives emails and gets retargeted for a few weeks.

Then your brand rides off into the sunset unless the product is truly life-changing.

Reason #2 is an issue for almost every brand, consumable or not. A typical customer journey from nurture to loyalty looks like this:

- Order #1: Customer buys hero product from Category A

- Order #2: Customer buys hero product in a different color/flavor/etc

- Order #3: Customer buys hero product + another product from Category A

- Order #4: Customer buys from Category A & Category B

You need a strong hero product, and SKU variation within that hero product, to support this journey. If the customer can’t find products they like that align with this journey, they’re more likely to churn.

Side note: the “three week theory” of habit formation is a myth; habit formation timelines are highly individual, and some folks need up to a year to form a new habit. So selling a three week supply of your product isn’t a silver bullet.

Brands With Stronger Retention Rates Are Beating You In The Meta Auction

A file of active repeat customers becomes an incredibly valuable asset as your business grows. In year one, you might be doing an average of $1k/day in repeat business. But by year five, you might be doing $15k/day.

This semi-predictable base of repeat customer sales can help you scale your acquisition efforts. Let’s say your break-even aMER is 45% (you spend 45% of first purchase AOV on marketing).

If your brand is just starting out and you have almost nothing but new customer sales, you’ll want to set an aMER target that is comfortably below break-even. That way, if something goes wrong (Meta bug, macro headwinds, etc) you still have some cash flow cushion. Of course, this limits your ability to scale.

Now, imagine that you had roughly $15k in repeat sales coming in every day. The marketing costs associated with this revenue are close to zero. You can set your aMER target closer to breakeven because you know that your repeat customers are covering your cash needs.

Does every brand with a strong repeat business operate like this? No. But some of the fastest growing DTC-first brands with sales in the $30-50M range use this strategy to reach the nine figure mark.

These are the brands who are kicking your butt in the Meta auctions. They’re doing everything right from a Meta tactics POV and they’re pushing the limit of first order profitability.

There are two ways to build up your customer file faster:

- Acquire more new customers (they need to be new before they repeat).

- Improve your 1st -> 2nd purchase conversion rate aka repeat rate (they need to buy a second time before they can become loyal).

But, as I mentioned in the previous section, it’s hard to improve your repeat rate without the right combination of product, marketing and customer insights. There are a lot of ways to do this right…and a lot of expensive, time consuming ways to do it wrong.

To give you some guidance, let’s look at how ILIA beauty solved this problem and drove a lift in the brand’s repeat rate and LTV in just six months.

How ILIA Beauty Worked With Segments Analytics To Boost Repeat Rate & LTV

“Segmentation” and “personalization” are big buzzwords in the retention marketing space. But there isn’t nearly as much talk about “execution” because…executing these strategies can be really challenging.

To run an effective segmentation strategy you need to identify actionable segments. And to take action against these segments, you need the resources to develop personalized messaging for each audience.

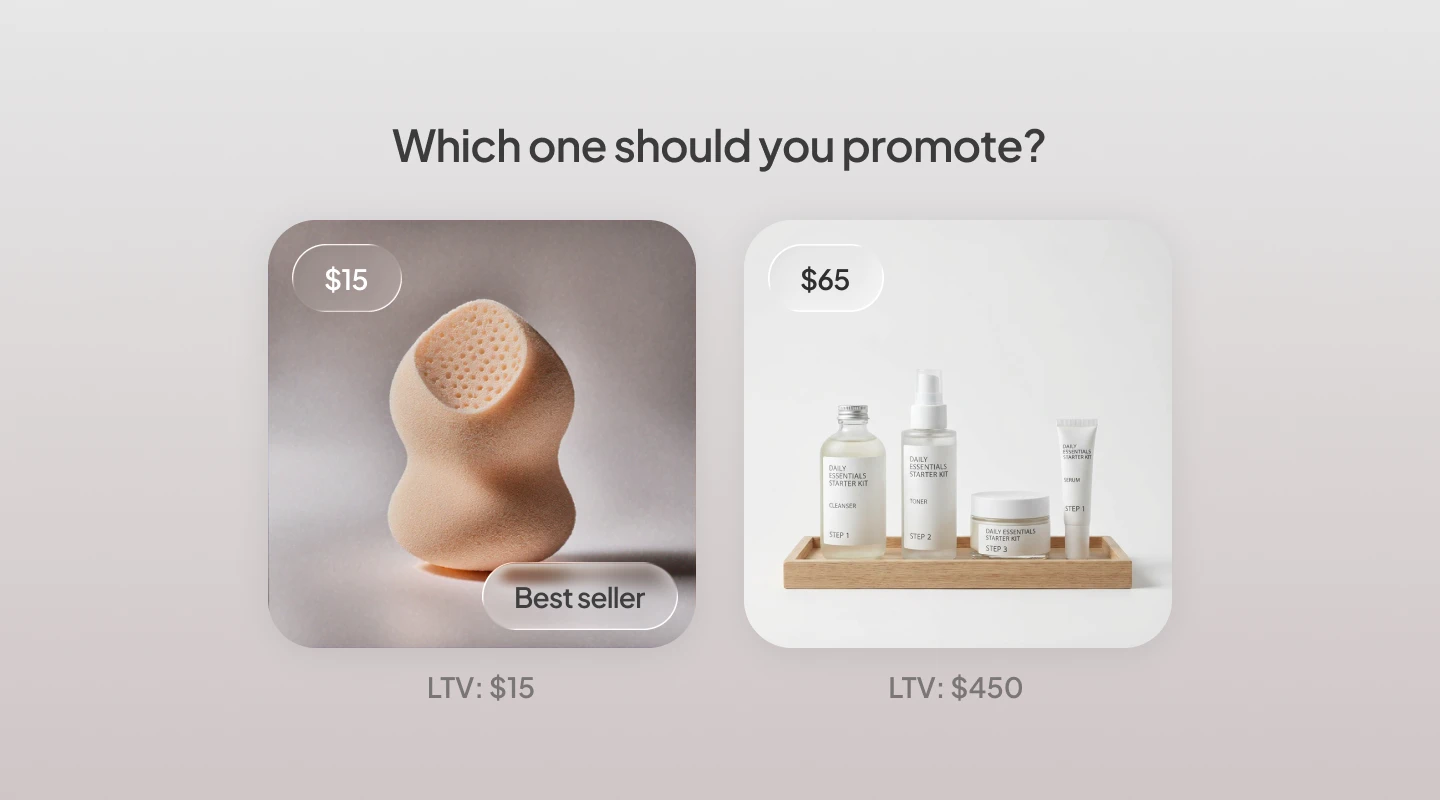

This was the challenge facing ILIA beauty. ILIA has a product assortment that spans multiple categories–foundation, lips, eyes, blush, etc.–but Skin Tint was the top hero product.

The brand’s VP of Digital wanted to know how customers interacted with the assortment. What did Skin Tint customers buy next? More Skin Tint, or other products? And were there “hidden gems” in the assortment–products or categories with smaller sales volume that brought in high LTV customers?

ILIA had relied on the personal experiences of its branding team and beauty advisors to answer some of these questions, but it knew the answers were buried in its customer data, and it was determined to find them.

The brand reached a common fork in the road that appears around the $25-50M annual revenue mark: “Should we build out an internal data team to answer these questions on our own?”

I can tell you from experience: developing in-house data capabilities always takes more time and costs more money than you think it will.

The team members who are maintaining your data warehouse and running SQL code on your transaction history are not the same team members who can tell you what questions to ask and how to take action on the answers. It takes a long time for this approach to bear fruit.

Instead of building out an internal data team, ILIA decided to partner with Segments Analytics, an action-oriented customer analytics platform.

Segments Analytics is a great option for brands who want a faster return on their investment in data and analytics. Here’s how it worked out for ILIA:

Segments Analytics ingested all of ILIA’s historical orders from Shopify and analyzed the product purchase sequence between the first, second, and third orders. This process took less than a few hours.

Using this data, Segments Analytics created a "Product Journey". This interactive report mapped out every single product purchase path, the number of customers, average CLV, and the timing between product purchases.

The Product Journey showed ILIA which products brought in the highest value customers. The marketing team could filter each purchase path by date and customer attributes, letting them answer deeper questions without waiting for a data analyst to run code.

Using the Product Journey, the ILIA team uncovered several key insights. Some validated their original hypothesis (what they always thought was true but couldn’t prove), and others provided new insights they hadn’t considered:

- Customers who used their second purchase to replenish the same tint color from their first order waited for 2x as long when compared to the average 2nd purchase.

- If customers changed to a different tint color, they were much more likely to choose a darker one.

- A high percentage of serum purchasers had previously bought skin tint.

Product journey also provided item-level repurchase timing for every combination of products, which allowed ILIA team to optimize the timing of their flows and campaigns.

Backed by data, the ILIA team now had the confidence to create and test targeted campaigns and marketing journeys based on the insights from Segments Analytics. In the six months after launching these campaigns ILIA saw a brand-level lift in repeat purchase rate and the average number of orders per customer.

The entire process, from data ingestion to the first campaign launch, took only 1.5 months. This same project can easily take six months or more to implement if brands opt to use an in-house data team, even if that team is already in place.

Actionable Insights: How You Can Boost Your Repeat Rate & LTV

ILIA’s success with their post-purchase journeys reinforces something I say a lot on here: converting new customers to a second purchase is the #1 bottleneck to loyalty and LTV.

Here are some actions you can take to help your brand grow:

- Do you have a post-purchase email journey set up? If not, build one now! The first step is getting something simple in place.

- So, you already have a post-purchase journey set up? If so, extend it! This is your chance to speak to “nurture” phase customers. You can send up to 3-5 emails per week over 2-3 weeks.

- So, your post-purchase journey is already robust? Now it’s time to build out separate journeys based on your most common first purchase baskets. If you have a broad product assortment with lots of variability here, a tool like Segments Analytics can help you identify common first purchase baskets, what those folks tend to purchase next, and the precise timing of item-to-item purchases.

- What are your daily average sales from repeat customers? Can you use this number to lower your aMER target, allowing you to get more aggressive with spend? Check with finance first!

Want to learn what Segments Analytics can do for your repeat rate and LTV? Click here to try it free for 14 days.